Treasury Trims Borrowing Estimates After Issuing Much More Debt Than Expected Last Quarter

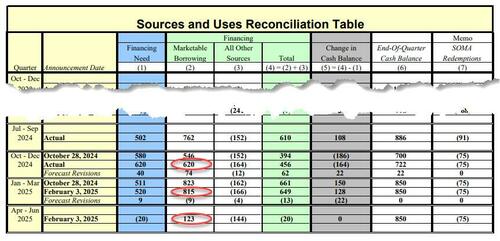

Ahead of Wednesday’s Quarterly Refunding Announcement, at 3pm ET the Treasury published its latest debt sources and uses forecast for the current and coming quarters, and it showed that the Treasury again marginally trimmed its estimate for borrowing for the current quarter ($815BN vs $822BN estimated previously), while raising materially more debt than it previously expected in the quarter ended Dec 31 ($620BN vs $546BN estimated previously).

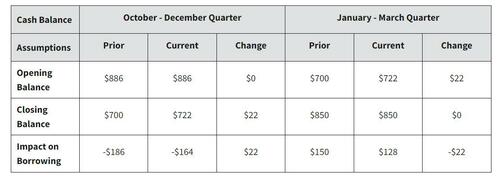

The Treasury also revealed that its year-end cash balance was $722 billion, higher than the $700 billion forecast, which as reported previously, is just before the federal debt ceiling kicked back in.

Looking ahead, the Treasury expects to raise just $123 billion in new debt in the second calendar quarter of 2025 ending June 30; according to the Treasury both the end-of-March and end-of-June cash balance of $850 billion assumes enactment of a debt limit suspension or increase. That said, if the Treasury’s cash balance for the end of either quarter is lower than assumed, and assuming no changes in the forecast of fiscal activity, Treasury would expect that borrowing would be lower by the corresponding amount.

Here are the details from the Treasury statement

- During the October – December 2024 quarter, Treasury borrowed $620 billion in privately-held net marketable debt and ended the quarter with a cash balance of $722 billion. In October 2024, Treasury estimated borrowing of $546 billion and assumed an end-of-December cash balance of $700 billion. Privately-held net marketable borrowing was $74 billion higher largely because of lower net cash flows and a higher ending cash balance.

- During the January – March 2025 quarter, Treasury expects to borrow $815 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $850 billion. The borrowing estimate is $9 billion lower than announced in October 2024, largely due to a higher beginning-of-quarter cash balance, partially offset by lower net cash flows.

- During the April – June 2025 quarter, Treasury expects to borrow $123 billion in privately-held net marketable debt, assuming an end-of-June cash balance of $850 billion. As noted above, the end-of-March and end-of-June cash balances assume enactment of a debt limit suspension or increase.

- Treasury’s cash balance may be lower than assumed depending on several factors, including constraints related to the debt limit.

- If Treasury’s cash balance for the end of either quarter is lower than assumed, and assuming no changes in the forecast of fiscal activity, Treasury would expect that borrowing would be lower by the corresponding amount

Here is the debt schedule in table format:

The Treasury’s cash balance stood at about $826 billion as of Thursday, or roughly where the Treasury hopes it will be at the end of the quarter. As reported two weeks ago, the US federal debt ceiling cap kicked back just days before Trump’s inauguration. Any drawn-out episode in Congress over raising or suspending the limit will force the Treasury to slash bill issuance and spend down its cash buffer.

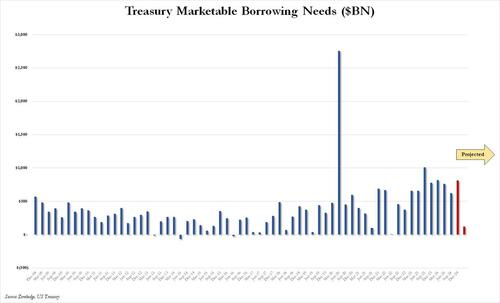

Meanwhile, the projected $815 billion borrowing need in Q1 2025 would still be tied for the highest since the Sept 2023 quarter.

As Bloomberg notes, some Treasury watchers have flagged the potential for the department to shift toward maintaining a smaller cash stockpile over time, though Monday’s estimates don’t reflect any such consideration; it would be the latest reversal by Trump’s Treasury Secretary Scott Bessent who initially pushed back against tariffs only to apparently concede that these are, in fact, needed potential inflation notwithstanding.

Wrightson ICAP economist Lou Crandall is among those who have mentioned the possibility of a small cash hoard. Ahead of Monday’s statement, he estimated $820 billion in borrowing for the current quarter, with an end-of-period cash balance of $850 billion. Anshul Pradhan, head of US rates strategy at Barclays, forecast that the January-through-March borrowing figure would be $800 billion, with the cash balance target set at $850 billion. Both of them got the quarter-end cash balance right.

On Wednesday, the Treasury department will announce its latest refunding plans plans (i.e. detailed debt issuance planes for over the coming months) which dealers widely see as staying unchanged. Yet, given outsize US fiscal deficits, dealers see increased sales of longer maturities is inevitable at some point; those in turn could push yields sharply higher.

Tyler Durden

Mon, 02/03/2025 – 15:43

Share This Article

Choose Your Platform: Facebook Twitter Linkedin