Accounting Error Sends Macy’s Shares Tumbling; Goldman Calls Earnings “Disappointing”

Macy’s reported its financial results for the third quarter on Wednesday and slashed its outlook after concluding an investigation into an employee who intentionally hid $151 million in delivery expenses from the fourth quarter of 2021 through the third quarter of this year.

During an earnings call on Wednesday morning, Macy’s CEO Tony Spring told investors that “integrity is paramount at Macy’s,” adding, “The responsible individual is no longer with the company, following discovery of their actions.”

Spring continued, “We’ve also identified and begun to implement additional controls to be a stronger and more disciplined organization so that an action like this could not happen again.”

In late November, Macy’s delayed its third-quarter report due to an investigation and forensic analysis that specified a “single employee with responsibility for small package delivery expense accounting intentionally made erroneous accounting accrual entries to hide approximately $132 to $154 million of cumulative delivery expenses from the fourth quarter of 2021 through fiscal quarter ended November 2, 2024.”

As a result, the department store chain lowered its full-year guidance, estimating an impact of $79 million. Adjusted earnings per share were revised downward to a range of $2.25 to $2.50, compared to a previous forecast of as high as $2.90 in August.

However, Macy’s raised its full-year sales forecast …

Here’s the revised full-year forecast (courtesy of Bloomberg):

-

Sees adjusted EPS $2.25 to $2.50, saw $2.55 to $2.90

-

Sees net sales $22.3 billion to $22.5 billion, saw $22.1 billion to $22.4 billion

-

Sees gross margin rate 38.2% to 38.3%, saw 39% to 39.2%

Here’s what the retailer reported for the third quarter (courtesy of Bloomberg):

-

Adjusted EPS 4.0c vs. 21c y/y, estimate 3.5c (Bloomberg Consensus)

-

EPS 10c vs. 15c y/y

-

Total revenue $4.90 billion, estimate $4.91 billion

-

Net sales $4.74 billion, -2.4% y/y, estimate $4.76 billion

-

Gross margin 39.6% vs. 40.3% y/y, estimate 40.4%

-

Inventory $6.26 billion, +3.9% y/y, estimate $5.65 billion

-

SG&A expense $2.06 billion vs. $2.04 billion y/y, estimate $2.07 billion

-

Owned basis comparable sales -2.4%

-

Owned plus licensed comparable sales -1.3%, estimate -1.39%

Shares of Macy’s fell in premarket trading, down about 11%. On the year, shares closed down 17% on Tuesday.

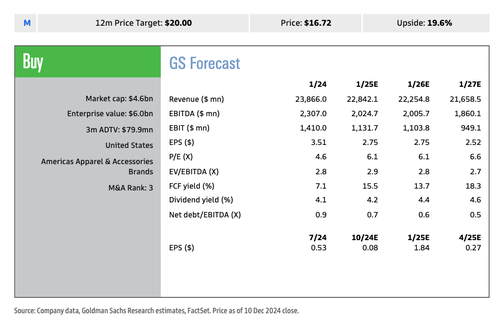

Commenting on the earnings report, Goldman’s Brooke Roach and Evan Dorschner called the results “disappointing” …

M reported adj. F3Q24 EPS of $0.04, below GSe at $0.08 and in line with Factset consensus. Owned reported comps at -2.4% and retail sales of $4.742bn were in line with preliminary results announced on November 25th, 2024. However, profit was reported below expectations, with gross margins contracting to 39.6% as a % of retail sales, below GS/consensus at 40.5%/40.4%. This more than offset well-controlled SG&A, driving adj. EBIT to 0.9% vs. GS/consensus 1.2%/1.4%. Inventories were in line preliminary results.

On the forward outlook, M lowered its EPS guidance to $2.25-$2.50 (vs. $2.55-$2.90 prior), compared to GS/consensus at $2.75/$2.73. Within this, $0.21 of the reduction in guidance was driven by the adjustment to delivery expense following the company’s concluded accounting investigation. Beyond the delivery expense adjustment, Macy’s further reduced its EPS guide, now calling for lower gross margins and adj. EBITDA margins despite a stronger comp forecast. For 4Q, Macy’s guide for $7.8-8.0bn in net sales and $1.40-$1.65 of EPS compares to consensus at $7.7bn and $1.87, respectively. After adjusting for delivery expense in 4Q at $0.17, M’s 4Q guide is below consensus.

This is a disappointing result for Macy’s. While we are encouraged by the company’s stronger comp trend (especially in comparison with peers), we believe investors will focus on the company’s lower gross margin guidance and weaker EPS outlook for the year.

The analysts maintain a “Buy” rating on Macy’s with a 12-month price target of $20. This PT is based on 3.5x Q5-Q8 EV/EBITDA and includes a $1 per share contribution value from the retailer’s real estate.

Macy’s is currently undergoing a turnaround effort. The struggling retailer is a current activist target of Barington Capital and the private equity firm Thor Equities, which advocate for reducing administrative costs, trimming inventory, selling luxury brand stores, and exploring sales of its real estate portfolio.

Tyler Durden

Wed, 12/11/2024 – 09:15

Share This Article

Choose Your Platform: Facebook Twitter Linkedin