ECB Cuts Rates For The Fifth Time By 25bps As Expected, Signals More Rate Cuts

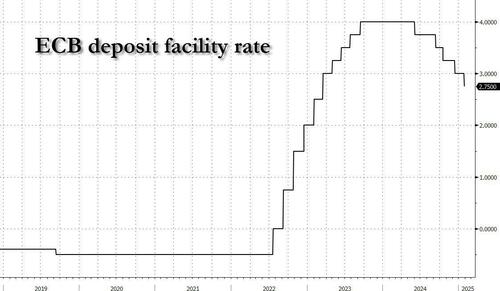

As we noted in our preview, and as widely expected, the ECB cut rates by 25bps as expected, its 5th consecutive rate cut since the central bank launched its easing cycle in June 2024. Specifically, the interest rates on the deposit facility, the main refinancing operations and the marginal lending facility will be decreased to 2.75%, 2.90% and 3.15% respectively, with effect from 5 February 2025.

In the accompanying policy statement the ECB said it was not pre-committing to any particular rate path. It said it was determined to ensure that inflation stabilises at 2%. The ECB said the disinflationary process is on track, and said that inflation should be back to 2% this year.

Some more highlights from the report:

POLICY STANCE:

- Financing conditions continue to be tight, also because monetary policy remains restrictive and past interest rate hikes are still transmitting to the stock of credit, with some maturing loans being rolled over at higher rates.

ECONOMY:

- Economy is still facing headwinds but rising real incomes and the gradually fading effects of restrictive monetary policy should support a pick-up in demand over time.

INFLATION:

- The disinflation process is well on track. Inflation has continued to develop broadly in line with the staff projections and is set to return to the Governing Council’s 2% medium-term target in the course of this year

- Domestic inflation remains high, mostly because wages and prices in certain sectors are still adjusting to the past inflation surge with a substantial delay.

- But wage growth is moderating as expected, and profits are partially buffering the impact on inflation.

GUIDANCE:

- The Governing Council is not pre-committing to a particular rate path.

- Monetary policy remains restrictive and past interest rate hikes are still transmitting to the stock of credit, with some maturing loans being rolled over at higher rates.

- It will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance.

As Bloomberg summarizes, in its statement, the ECB still describes monetary policy as “restrictive” even after today’s cut. That’s signaling more easing is in the pipeline, because almost all officials have said that now the aim is to bring rates to a neutral level that no longer restricts activity. But the extent and pace of further moves remains open, with the guidance unchanged.

Commenting on the ECB decision, here is DB’s Chief European Economist Mark Wall:

“The January Governing Council meeting falls into the ‘nothing to see here, move along’ category. The economic recovery is still facing headwinds. Disinflation remains on track. Interest rates are restrictive. As such, the ECB has cut policy rates again. This is the fifth cut in total and the fourth in quick succession. There is really no reason to think the ECB won’t continue to cut rates, at least to a neutral level, and we think quite probably below neutral by year-end.”

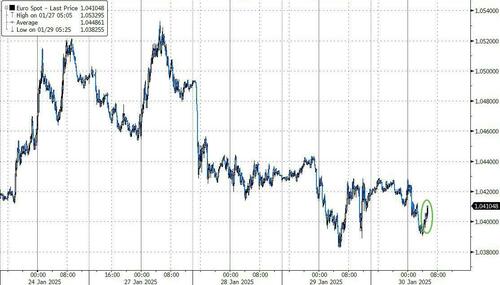

The euro stays lower after the European Central Bank cut interest rates by 25 basis points as widely expected. Watch the press conference live here (due to start at 0845ET):

Now it’s up to Lagarde to say more – or not. Watch the press conference live here (due to start at 0845ET)

Tyler Durden

Thu, 01/30/2025 – 08:24

Share This Article

Choose Your Platform: Facebook Twitter Linkedin