German Politicians Worry About Their Gold In US Vaults

For decades, the idea that Germany’s gold reserves – some of the largest in the world – might not be safe in the vaults of the New York Federal Reserve would have seemed like the stuff of conspiracy theories. But as the political landscape shifts in Washington – and questions have been raised as to what’s actually in US vaults, some German lawmakers are beginning to wonder aloud: Is their gold still secure?

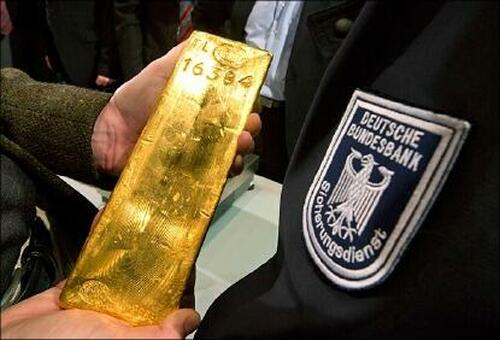

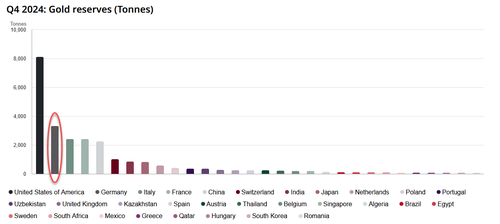

Germany holds the second-largest hoard of gold on the planet, surpassed only by the United States itself. Roughly 37 percent of that treasure – some 1,236 metric tons, currently valued at around €113 billion – supposedly lies deep beneath the streets of Manhattan, stored with America’s central bank. For decades, the arrangement was seen as a prudent hedge, offering Germany immediate access to dollar liquidity in the event of a crisis.

Now, some in Berlin are rethinking that assumption.

“Of course, the question now arises again,” Marco Wanderwitz, an outgoing lawmaker from the center-right Christian Democratic Union (CDU), told the German tabloid Bild (owned by POLITICO parent company Axel Springer) last week. Wanderwitz has long harbored doubts about the wisdom of keeping such a significant portion of the country’s wealth abroad. In 2012, he made an unsuccessful push to personally inspect the gold, urging the Bundesbank to act more transparently – or bring the bullion home.

Fellow CDU member Markus Ferber, a member of the European Parliament, echoed those sentiments, calling for more rigorous oversight. “Official representatives of the Bundesbank must personally count the bars and document their results,” Ferber told the outlet.

These calls come at a time of deepening skepticism toward the institutions that once underpinned Germany’s postwar confidence. The recent decision to discard the so-called “debt brake,” a long-sacrosanct cap on public borrowing, signaled a willingness to rethink long-standing fiscal orthodoxy. The logic behind storing Germany’s gold in New York, once assumed to be self-evident, is now coming under similar scrutiny.

Adding to the speculation is Elon Musk and DOGE, who have questioned the authenticity of stated U.S. gold holdings – recently calling for a formal audit of America’s reserves.

For the Deutsche Bundesbank, which oversees the management of Germany’s reserves, any suggestion of instability is unwelcome. The central bank has maintained a quiet and resolute stance, rebuffing insinuations of risk.

“We have a trustworthy and reliable partner in the Fed in New York for the storage of our gold holdings,” Bundesbank President Joachim Nagel said at a press conference in February, a line the bank reiterated when asked for comment on Friday. “It does not keep me awake at night. I have complete confidence in our colleagues at the American central bank.”

Famous last words…

In 2013, amid a populist outcry and growing eurozone instability, the ‘completely confident’ Bundesbank repatriated hundreds of tons of gold previously held in Paris – a move that was seen at the time as a symbolic reassertion of sovereignty. The bank argued that, with France and Germany sharing the euro, the strategic rationale for keeping reserves in Paris had faded.

Now, more than half of Germany’s gold sits safely in Frankfurt. Thirteen percent is held in London. But it is the tranche in New York – once a monument to transatlantic trust – that is drawing the most anxious of glances.

* * *

One question… GOT GOLD?

Tyler Durden

Wed, 04/02/2025 – 05:45

Share This Article

Choose Your Platform: Facebook Twitter Linkedin