Gold Futures Top $3,000 For First Time Ever

Update (1720ET): Gold prices continued to ratchet higher all day and shortly after the cash equity trading close, gold futures

This surge in futures comes after COMEX announced a massive 410k delivery…

There it is +410K (all JPMorgan and Brinks): biggest delivery in a month. Big, but hardly earthshattering

If this is enough to push gold up 1.6%, we are about to get major fireworks https://t.co/UsauPG0ZEV pic.twitter.com/cUUCb9UTnf

— zerohedge (@zerohedge) March 13, 2025

* * *

Spot Gold prices broke out to a new record high this morning following President Trump’s latest threat to ratchet up tariffs against European imports.

Spot prices hit $2974 this morning…

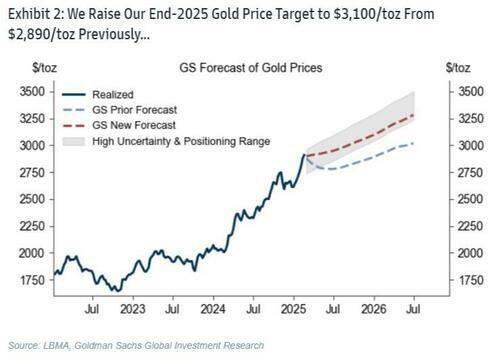

This moves come just a couple of weeks after “Structurally higher central bank demand” pressured Goldman Sachs Precious Metals Research team to shift their year-end 2025 gold price forecast dramatically higher, from $2890 to $3100/toz with Lina Thomas and the team reiterating their ‘long gold’ trading recommendation.

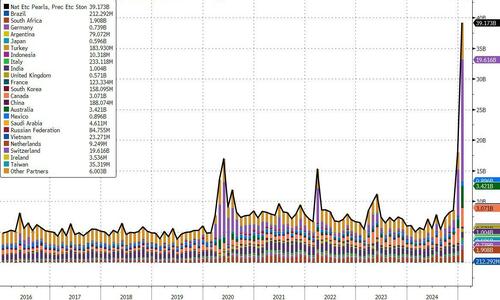

The chaotic situation in the physical gold market remains with precious metal imports exploding…

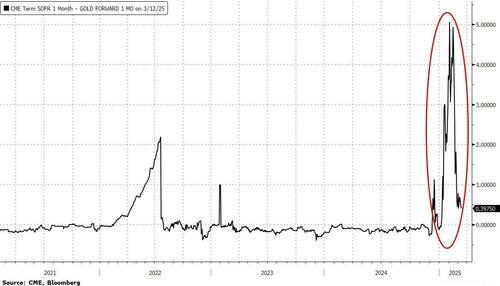

…and while gold lease rates have normalized somewhat…

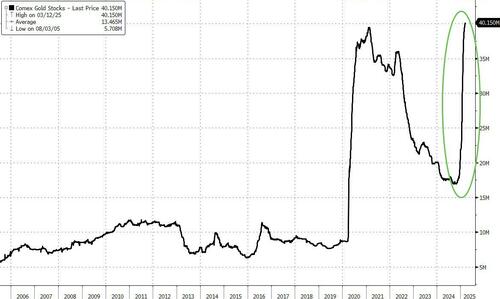

…the flow in COMEX vaults continues. Every single day for the past 3 months physical gold has been delivered to COMEX vaults bringing the total to a record 40.15MM oz or 1,250 metric tons

Precious metal speculators may have a problem as they reduced length into this surge…

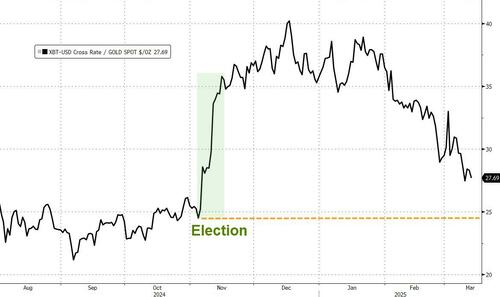

Finally, we note that Gold’s recent strength has almost entirely erased bitcoin’s outperformance since the election…

Barbarous relic vs digital gold – who will win?

Finally, Goldman estimates a 5% additional rise in gold prices by December 2025 to $3,250 if concerns over US fiscal sustainability were to grow.

Rising fears of inflation and fiscal risks could drive speculative positioning and ETF flows higher, while US debt sustainability concerns may push central banks, especially those holding large US Treasury reserves, to buy more gold.

Professional subscribers can read the full precious metals note here…

Tyler Durden

Thu, 03/13/2025 – 17:15

Share This Article

Choose Your Platform: Facebook Twitter Linkedin