Goldman Turns Bullish On Starlink Satellite Parts Supplier As Space Race Accelerates

The space race to connect the world to the internet is led by Elon Musk’s SpaceX’s Starlink, alongside competitors like OneWeb, Amazon, and Telesat. These players are deploying massive constellations of low Earth orbit (LEO) satellites, with plans to launch tens of thousands of new units by the decade’s end, with some 7,000 LEO satellites already orbiting the planet every 90 minutes.

With tens of thousands of new LEO satellites slated for deployment over the next five years, Goldman analysts have identified the global leader in satellite components—particularly hollow metallic waveguides. These waveguides are used in microwave or mmWave components, such as power amplifiers, filters, circulators, and isolators. Such components are integral to both LEO satellites and ground-based gateways used by Starlink and Amazon, which transmit data skyward to be relayed around the globe.

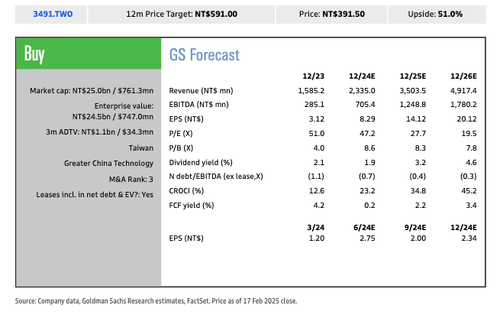

Goldman’s Allen Chang, Verena Jeng, and others informed clients Monday that they initiated a “Buy” on Universal Microwave Technology (UMT) because of its unique exposures to the mmWave/ microWave components for LEO satellites as launch plans for these satellites are accelerated.

Chang and the team provided clients with additional insight into UMT’s current position as a global leader in LEO satellite components for mmWave/ microWave components:

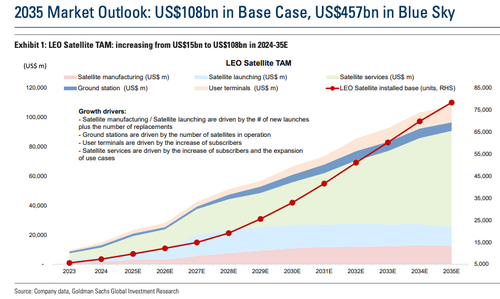

We expect LEO satellites to be a standard service in the 6G era starting in 2030, driving network deployment to grow at 49% CAGR in 2025-27E. Major global satellite operators target to launch an additional 80k units (vs. 7k in the sky currently) in the coming 5 years.

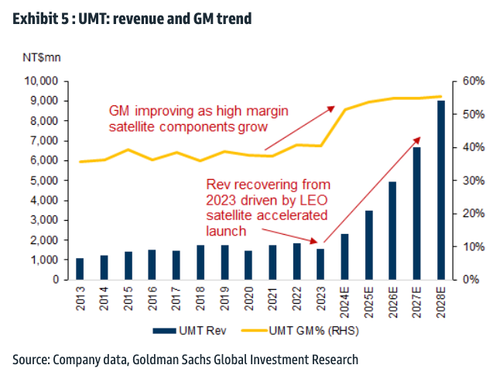

The acceleration of LEO satellite launches will drive UMT’s revenues: we expect UMT’s LEO satellite revenues to grow at 40% CAGR in 2024-28E to NT$9bn in 2028E or 77% of total revenues. LEO satellites carry higher GM than UMT’s traditional telecom products, driving the blended GM to 55.5% in 2028E (vs. 51.3% in 2024E).

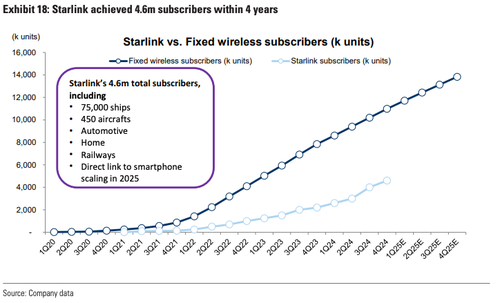

The analysts expect an accelerated ramp-up of satellite network deployment, such as Starlink’s Direct to Cell connection, and other companies deploying LEO satellites to greatly benefit UMT.

UMT’s projected revenues:

The company is poised to maintain a leading role for years to come, as analysts noted, due to “barriers to entry of satellite microwave components.”

Here’s more color:

Unlike smartphones/ consumer electronics RF (radio frequency), satellites use microwave/ mmWave with higher frequency and a more complicated structure with high-precision processing, which is difficult for consumer-grade supply chain players to enter.

Their 12-month price target is around NT$591 (implying a 51% upside) based on 25x 2027E discounted P/E.

UMT shares trading in Taiwan…

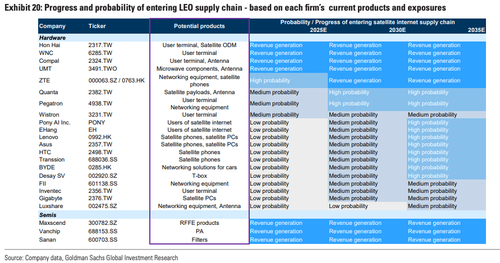

In a separate note, the analysts provided clients with a broader overview of companies entering LEO supply chains.

What comes after the AI bubble? Potentially, it’s the space bubble.

Tyler Durden

Tue, 02/18/2025 – 18:50

Share This Article

Choose Your Platform: Facebook Twitter Linkedin