Goldman: “US Gas Rally Likely Too Much, Too Soon”

Henry Hub spot natural gas prices surged to $4.90/mmBtu on Monday morning, reaching fresh two-year highs as traders weighed the impact of tariffs on Canadian fuel and potential retaliatory measures. Amid the volatility, Goldman Sachs’ co-head of Global Commodities Research, Samantha Dart, clarified what’s next for prices, warning, “US Gas Rally Likely Too Much, Too Soon.”

Dart said the sharp increase in Henry Hub spot NatGas prices has been a combination of colder-than-average temperatures, which, along with production freeze-offs and a quick ramp-up of liquefaction operations at the newly started 1.4 Bcf/d phase one of the Plaquemines LNG export facility in Louisiana, helped draw down salt inventories to very low levels.

Despite Dart’s forecast that 2026 prices will remain above $4/mmBtu to support drilling in Haynesville, the recent front-end price spike appears excessive.

She identified two key downside risks for NatGas prices:

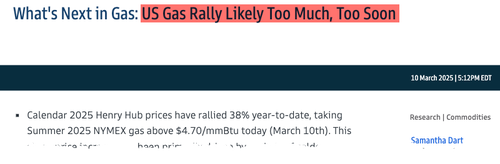

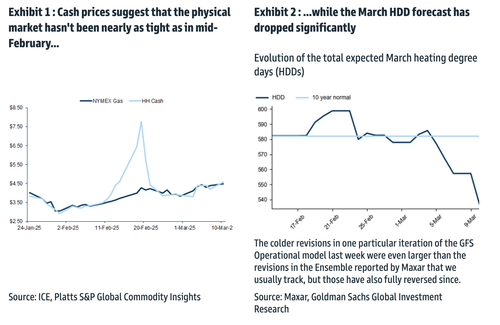

1. First, last week’s US gas rally that took prompt gas prices back above $4/mmBtu was not accompanied by any significant tightness in the physical market like what we observed in mid-February, and the colder March weather forecasts that arguably triggered that rally have fully reversed (Exhibit 1 and Exhibit 2).

2. Second, this week’s downward revision to US gas production estimates by Wood Mackenzie[2] still leaves month-to-date production more than 1 Bcf/d above our expectations, suggesting no urgency for the market to incentivize a sharp increase in drilling this summer.

While storage congestion isn’t a near-term concern, demand-side switching to coal has been maxed out, and higher prices won’t impact supply. Given these factors, Dart noted the risk balance for NatGas prices has now “skewed to the downside,” advising clients to “close our long Apr26 NYMEX natural gas trading recommendation.”

More color from Dart:

To be clear, we don’t see US storage congestion appearing as a result of this latest rally in US gas prices, so there is no binding physical constraint forcing US gas prices immediately lower. This is in part because, on the demand side, gas-to-PRB-coal switching is already maximized with Henry Hub near $3.75/mmBtu, and, on the supply side, the impact of higher gas prices on drilling (and ultimately production) is slow. But we do think the balance of risks around US gas prices has changed and is now skewed to the downside. Accordingly, we take this opportunity to close our long Apr26 NYMEX natural gas trading recommendation, now priced around $4/mmBtu, for a potential gain of $0.80/mmBtu.

Too fast, too furious?

However, longer-range fundamentals, including rising LNG exports to Europe, indicate a much brighter future for NatGas following a multi-year price trough.

Tyler Durden

Wed, 03/12/2025 – 04:15

Share This Article

Choose Your Platform: Facebook Twitter Linkedin