Goldman’s Heat Map For Housing Market Ahead Of Spring Selling Season

Sales of US existing homes last year slumped to their lowest level since 1995. With the Federal Reserve expected to slash interest rates twice (2x 25bps) this year, homebuilders will likely thrive while the secondary market remains subdued.

Goldman’s Susan Maklari, Charles Perron-Piche, and others released a note this week highlighting single-family permits as a key real-time indicator of housing supply and demand trends across the broad US market and individual regions.

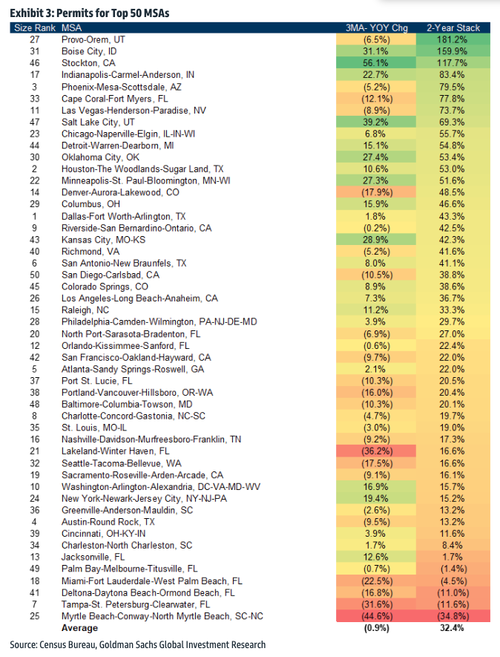

The analysts provided clients with a heatmap of homebuilders based on single-family permit activity over a 3-month and 12-month period, offering critical insights into future housing supply, builder confidence, and consumer demand.

Here’s what they found on a broad level and region by region:

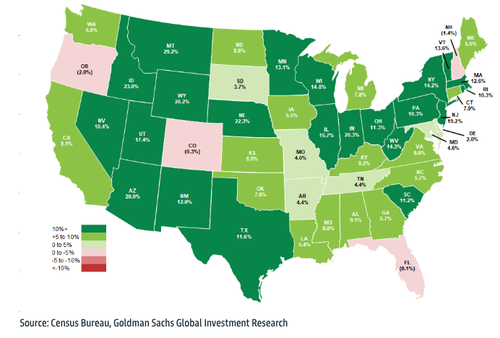

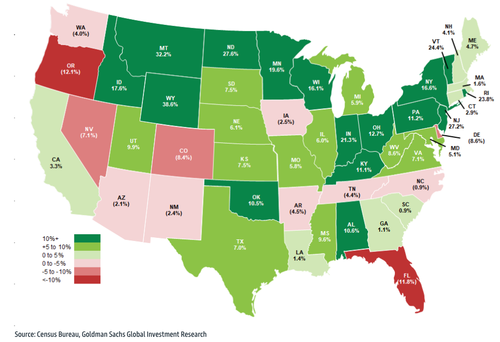

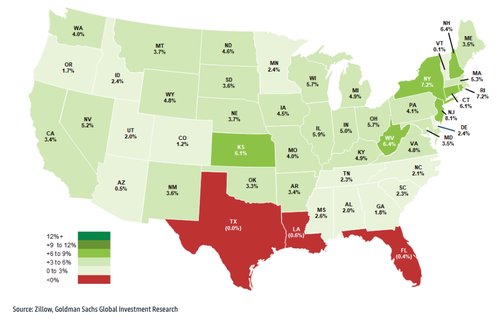

On a trailing 12-month basis, single-family permits rose 8% YOY in December, vs +10% in November and off a 6% decline a year ago. Single-family home values grew 3% YOY nationally according to Zillow, similar to the prior month, with 13 states seeing gains of 5+% vs 12 in November, while 34 rose 0-5%, down from 36 sequentially. Louisiana saw home values contract 1% YOY while Florida and Texas were roughly flat. That said, Nevada and Virginia both rose 5% and California increased 3% while Tennessee, Georgia, Utah, and the Carolinas were all +2%. The lift in permits comes despite the 30-year mortgage rate holding near 7% as the start of the selling season approaches and reflects builders’ willingness to use rate buydowns to support closings, at the expense of profitability.

…

Permits Rise on Rolling 3-Month Basis Despite Underperformance in Florida: Single-family permits for the 3-months ended December rose 2% YOY, compared to a 1% increase in November and off +25% a year ago, and grew 6% vs the comparable pre-pandemic period. There were 16 states that rose more than 10%, down from 17 in November. We note the relative underperformance of Florida as public builders across price points adjust to the rise in for-sale inventory over the last several months and ongoing weakness in key markets such as Tampa coming into the year. In our view, this should help stabilize conditions as these areas are also continuing to recover from the hurricanes last fall.

Trailing 12 Month Single-Family Permits by State

Trailing 3 Month Single-Family Permits by State

Southeast Markets Lag on MSA Basis: Permits in the top 50 MSAs decreased 1% YOY for the 3 months ended December, vs -2% in November and off +34% a year ago. On a YOY basis, Stockton, CA (+56%), Salt Lake City, UT (+39%), and Boise, ID (+31%) showed the greatest gains while Myrtle Beach, SC (-45%), Lakeland, FL (-36%), and Tampa, FL (-32%) lagged. On a 2-year stacked basis, growth was led by Provo, UT (+181%), Boise, ID (+160%), and Stockton, CA (+118%). On a 2-year stack, we note 7 of the top 10 MSAs are in the South or West.

Zillow Single-Family Home Value Index YOY % Change

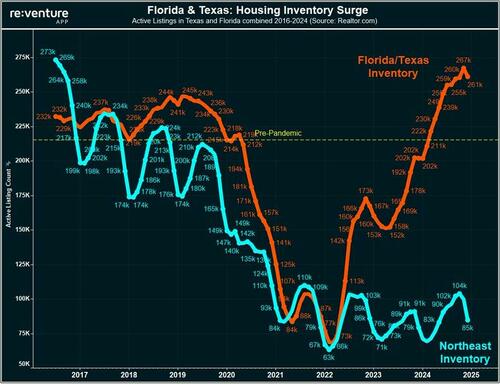

In a separate note, Nick Gerli, CEO and Founder of real estate analytics firm Reventure Consulting, wrote on X, “Probably my favorite housing market graph right now. Orange line is inventory levels in Florida & Texas, combined. Blue line is inventory level across entire Northeast US.”

The takeaway is that housing markets across the Sun Belt, like Florida, face mounting headwinds, such as elevated inventory, after several boom years during the Covid era of low interest rates. The heatmaps of single-family permits show a real-time pulse of these markets ahead of the spring selling season.

* * *

More on the housing market for prospective homebuyers…

Goldman Delivers Grim Outlook For Prospective Homebuyers https://t.co/MFOHGG4jn7

— zerohedge (@zerohedge) December 13, 2024

. . .

Tyler Durden

Thu, 01/30/2025 – 19:50

Share This Article

Choose Your Platform: Facebook Twitter Linkedin