Klarnageddon: Consumer Credit Card Debt Unexpectedly Plummets At Rate Signaling Deep Recession

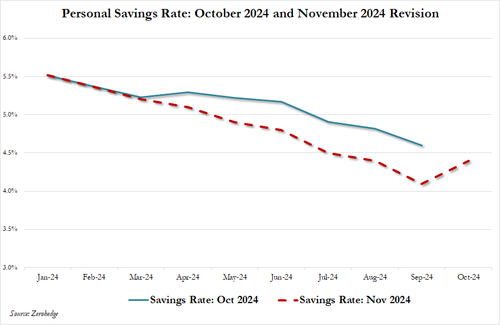

We have repeatedly warned that with their savings – and especially “emergency covid savings” – gone or nearly gone, Biden admin savings data manipulation notwithstanding…

… US consumers had no choice but to max out their credit cards in order to “extend and pretend” their moment of purchasing greatness, or as we called one month ago, their last hurrah (see In “Last Hurrah”, Credit Card Debt Explodes Higher Despite Record High APRs As Savings Rate Craters), a hurrah that would last very briefly as it was only a matter of months if not weeks before said cards were denied.

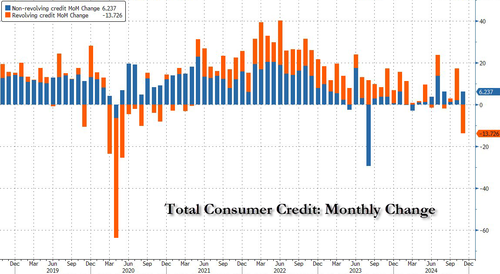

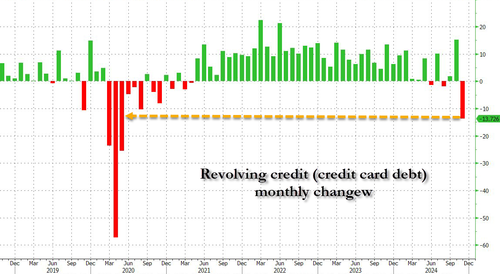

Well, it appears that said denial hit much sooner than expected, and according to the Fed’s latest consumer credit data, in November consumer credit across US households tumbled by $7.5 billion to $5.102 trillion, a 1.8% annual rate of contraction and usually something one only sees in the middle of recessions (or worse).

What is remarkable is that as shown on the chart above, while non-revolving debt (i.e. student and auto loans) rose modestly, it was revolving, or credit card debt, that cratered by a whopping $13.8 billion the biggest drop since the covid crash shut down the economy and the prospect of future income for millions of Americans (hence the collapse in spending). In fact, it is safe to say that any and every time revolving credit has collapsed this much, the US was on the cusp of, if not already in a recession.

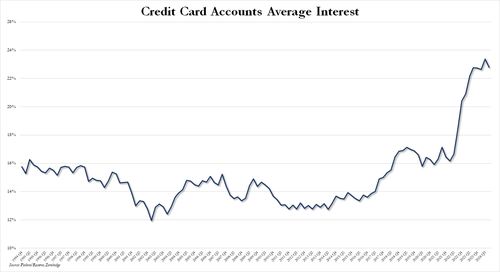

We don’t know what sparked this sudden reversal in the favorite American pastime – i.e., to buy stuff one can’t afford and hope to pay it back some time in the future for a modest 29.95% APR – but we know what didn’t: falling rates… because they didn’t. You see, three months after the Fed cut rates, taking them 100 bps below where they were in September (only to suddenly warn of a hawkish pivot now that Trump is in the White House), the average interest on credit card accounts across the US banking system as tracked by the Fed is at 22.8%, the second highest reading on record and a drop of 57bps from the highest rating on record taken in Q3 2024.

While we wonder if and when a politician will ask the US banks why they still charge such high interest when Fed Funds is down almost double from this post-Sept drop in average credit card balances, we doubt this will happen any time soon, because asking such pointed questions would mean the fake facade of a stable recovery (and not debt-funded spending frenzy) could lead to the entire house of cards falling over.

Tyler Durden

Wed, 01/08/2025 – 15:40

Share This Article

Choose Your Platform: Facebook Twitter Linkedin