LVMH Reports “Mixed” Results As Goldman Says “Buy On Any Weakness”

LVMH Moët Hennessy Louis Vuitton SE posted better-than-expected full-year sales but delivered mixed fourth-quarter results, highlighting a sluggish luxury recovery. Shares fell in European trading after the earnings report.

LVMH controls around 60 subsidiaries that manage 75 luxury brands. LVMH’s portfolio includes Christian Dior Couture, Givenchy, Fendi, Celine, Kenzo, Tiffany, and many more brands. It posted revenues of 84.68 billion euros ($88.27 billion) for 2024 versus 84.38 billion euros forecast by Bloomberg Consensus. This equates to organic growth of 1% versus the previous year.

Here’s a snapshot of LVMH’s full-year results (courtesy of Bloomberg):

Recurring operating income EU19.57 billion, -14% y/y, estimate EU20.45 billion

Fashion & Leather Goods recurring operating income EU15.23 billion, -9.5% y/y, estimate EU15.44 billion

Wines & Spirits recurring operating income EU1.36 billion, -36% y/y, estimate EU1.62 billion

Perfume & Cosmetics recurring operating income EU671 million, -5.9% y/y, estimate EU730.3 million

Watches & Jewelry recurring operating income EU1.55 billion, -28% y/y, estimate EU1.76 billion

Selective Retailing recurring operating income EU1.39 billion, -0.4% y/y, estimate EU1.48 billion

Revenue EU84.68 billion, -1.7% y/y, estimate EU84.38 billion

Fashion & Leather Goods revenue EU41.06 billion, -2.6% y/y, estimate EU40.91 billion

Wines & Spirits revenue EU5.86 billion, -11% y/y, estimate EU5.98 billion

Perfume & Cosmetics revenue EU8.42 billion, +1.8% y/y, estimate EU8.47 billion

Watches & Jewelry revenue EU10.58 billion, -3% y/y, estimate EU10.4 billion

Selective Retailing revenue EU18.26 billion, +2.1% y/y, estimate EU18.18 billion

Dividend per share EU13, estimate EU12.89

Net income EU12.55 billion, -17% y/y, estimate EU13.38 billion

Fourth-quarter sales through December beat the Bloomberg Consensus. However, the report was mixed, with fashion, leather goods, and wine continuing to lag. Most growth came from Europe, the US, and Japan, while Asia slumped.

Here’s a snapshot of LVMH’s fourth quarter:

Organic revenue +1%, estimate -1.04% (Bloomberg Consensus)

Fashion & Leather Goods organic sales -1%, estimate -2.82%

Wines & Spirits organic sales -8%, estimate -6.94%

Perfumes & Cosmetics organic sales +2%, estimate +3.51%

Watches & Jewelry organic sales +3%, estimate -2.82%

Selective Retailing organic sales +7%, estimate +3.13%

US organic revenue +3%, estimate +3.73%

Asia excluding Japan organic revenue -10%, estimate -12.1%

Japan organic revenue +8%, estimate +14.7%

Europe organic revenue +4%, estimate +3.37%

Revenue EU23.93 billion vs. EU23.95 billion y/y, estimate

Commenting on the earnings report, Goldman’s Louise Singlehurst, Ben Rada Martin, and Adrien Duverger told clients:

LVMH reported a mixed result with +1% Q424 group sales 2% ahead of consensus, whilst EBIT was below (-8%); however, given positive commentary for January we would buy on any weakness.

LVMH delivered organic sales growth of +1% cFX yoy in 4Q, ahead of Visible Alpha Consensus Data (-1%), with the largest division, Fashion and Leather, decreasing -1% cFX (ahead of cons. -3%, and sequentially improving vs. -5% in 3Q24).

Margins were lighter than expectations with 2H24 Adj. EBIT -8% below consensus, with broadly in line F&L (-1%) largely offset by misses in Wines and Spirits (-28%), Watches & Jewellery (-18%) and perfumes and Cosmetics (-16%). We note the outlook commentary was broadly upbeat, with Louis Vuitton and Tiffany (which account for c. 55% group EBIT on our estimates, FY24) growing double digits in 2025 to date (noting some benefit from earlier Lunar New Year timing).

Singlehurst and the other analysts said the “recent appreciation in LVMH’s share price (+20% last month)” with “mixed FY24 topline result” may not be enough to continue the momentum in shares seen over the few months.

However, they maintained a “Buy” rating on LVMH for these three reasons:

-

An improving shape of the Chinese Cluster and indications that demand has troughed in Q324 for the broader peer group;

-

an acceleration in US trends in Q4 and positive outlook commentary for 2025 and

-

scope for margin recovery with the return to positive sales growth.

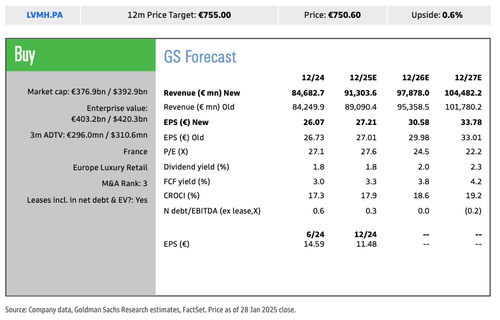

GS Valuation – Remain Buy; PT €755 (from €720)

Here are the key takeaways of LVMH’s earnings from other institutional desks (courtesy of Bloomberg):

JPMorgan (neutral)

- “An improvement, but not the magnitude hoped,” says analyst Chiara Battistini

- While numbers did improve sequentially, with in particular fashion & leather-goods at -1% in 4Q (vs -5% in 3Q), the pace of acceleration did not match that seen at peers so far, nor higher buyside expectations

- This confirms that brand- and category-specific dynamics continue to play an essential role to drive traction with still very discerning consumers

- Report also shows that even the best-in-class player can’t fully contain operating deleverage, with 2H margins missing at most divisions * Would not chase the recent LVMH (and sector) rally

Deutsche Bank (hold)

- LVMH’s sales were weaker than expected, says analyst Adam Cochrane, though trading looks to have improved over the quarter and accelerated into January

- Notes that the -1% fashion & leather-goods sales print was below the 2-3% investor bar following Richemont and Burberry’s results

Stifel (buy)

- While LVMH saw an improving sales trend, the expectations bar got higher, writes analyst Rogerio Fujimori

- Among positives, notes that all nationalities improved q/q, key brands like Dior and Tiffany accelerated in the fourth quarter, and both Louis Vuitton and Tiffany saw double-digit growth in January

TD Cowen (buy, PT raised to €840 from €800)

- Results are better than feared, says analyst Oliver Chen, driven by an acceleration across the watches & jewelry and fashion & leather-goods segments.

- While growth for Tiffany and Louis Vuitton is encouraging, other core brands in the portfolio such as Dior may need more product innovation to reignite cultural relevance

Telsey Advisory Group (outperform, PT raised to €820 from €750)

- Strength in most geographies in the fourth quarter helped offset continued declines in Asia ex-Japan, says analyst Dana Telsey

- Although consumer confidence in China remains challenging, LVMH’s broadly diversified portfolio of strong brands across product lines and geographies is beneficial

Bernstein (outperform)

- While LVMH’s fashion & leather-goods organic growth beat expectations, it failed to stand up to upgraded expectations on the back of Richemont’s recent major beat, writes analyst Luca Solca

- LVMH has work to do at Dior, as well as in other divisions

Jefferies (hold)

- LVMH’s results confirm the “exceptional” nature of the fourth- quarter acceleration reported by some, and a diverging demand in favor of hard versus soft luxury, says analyst James Grzinic

- Talk of a strong showing by Dior in 2024 and a positive double-digit in January-to-date sales at Louis Vuitton and Tiffany will be debated and contrasted with China’s long-haul recovery

Morgan Stanley (overweight)

- Investor sentiment on LVMH had moved up and as such analyst Edouard Aubin expects that “at first glance” the report will disappoint investors

- LVMH’s 4Q sales beat consensus by about 2%, a “smaller beat than what we have typically been seeing in luxury reporting year to date,” the analyst writes

- For the “key sentiment driver of the stock,” the fashion & leather-goods segment saw organic sales drop 1% in 4Q, which is better than the consensus view, but below investor expectations of around flat to up 3%

- Furthermore, the q/q acceleration in sales for that segment, from down 5% in 3Q to the 1% drop in 4Q, is below peers Richemont and Burberry Group

RBC (outperform)

- “These results are mixed but arguably also as expected,” with the top line slightly better, as anticipated after Richemont, Brunello Cucinelli and Burberry reports, while margins and profitability were lower than expected, analyst Piral Dadhania writes

- Figures Street consensus estimates for fiscal 2025 may come down by mid-single digits

Bloomberg Intelligence

- LVMH confirmed the view that the demand slowdown passed its nadir for luxury goods in the the third quarter, says analyst Deborah Aitken, with a gradual pickup in all regions into the fourth

- However, volume recovery and limited pricing could take two years to repair a weaker operating margin

LVMH Chief Executive Officer Bernard Arnault provided investors with an understanding of the luxury market’s forecasted recovery shape: “What I expect is to see a gradual recovery,” adding, “The environment was severely impacted by Covid, then there was a strong recovery, followed by another crisis — the real estate crisis — so it’s going to take some time.”

Tyler Durden

Wed, 01/29/2025 – 07:20

Share This Article

Choose Your Platform: Facebook Twitter Linkedin