The Most Difficult Question: Where Is The Economy Headed?

By Peter Tchir of Academy Securities

Where Is the Economy Headed?

In hockey, they always say skate to where the puck will be, not to where it has been. We always have to do that in our business, but it seems particularly difficult right now:

- Given the errors inherent in much of the data, it is difficult to know where we actually are, let alone where we are going.

- Trump 2.0 is coming out of the gate with so many potential policies that it is difficult to track, let alone understand, what will get implemented and what it will do.

Understanding those issues, let’s see what we can come up with.

The Economy Is NOT as Good as the Current Data Suggests

I continue to think that the jobs data is heavily overestimated, especially at the start of the year. The seasonality issues I have with the jobs data are:

- It includes the Covid shutdown and reopening, which played havoc with seasonals, giving us too big of an adjustment early in the year.

- It continues to be skewed towards traditional weather pattern issues, where jobs are added in the winter due to decreased construction in the Northeast.

While I believe that the BLS is getting better at understanding how the gig economy is creating EINs at a pace that produces far fewer jobs than we used to get, I don’t think they fully account for that yet.

While I’m not going to pound my fist on the table on inflation seasonals, I do think they face some similar issues, causing inflation at the start of the year to be overstated.

So, my starting point, i.e., where the puck is, is not as strong as the official data suggests.

Policies Don’t Need To Be Implemented to Impact the Economy

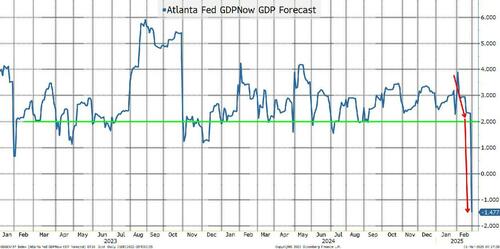

Let’s start by looking at this chart. It has some flaws, which we will go through, but it illustrates the point quite well – that intended, or even potential policy, can meaningfully affect the economy.

The Atlanta GDPNow forecast has been pretty good. It just plummeted.

- The drop is almost entirely due to trade!

- The advanced trade balance dropped to -$153 billion. That compares to -$129 in March of 2022 (the next worst print) and an average of -$64 billion going back to 2000.

- The Atlanta GPDNow forecast does tend to overstate recent economic data, especially near the beginning of a quarter (more data comes in, etc.) and when it incorporates new data.

Some of this is likely to reverse as it was a preemptive reaction to potential tariffs by companies across the globe.

Having said that, how much will be undone? What does it mean for spending and the economy going forward if some things were “pulled forward” in anticipation of tariffs?

While this looks bad for GDP, it probably made inflation tick higher (rush to purchase and get things delivered ahead of tariffs) and maybe propped up the jobs data.

The importance of reactions to anticipated policies cannot be overstated. Companies are all skating to where the puck might be. And the longer the policies are anticipated, the more that will be done, making “undoing” it more difficult.

Waiting for Headlines from D.C.

We may see tariff information related to Canada and Mexico this weekend. Are they doing enough to get another extension? Coming into the weekend, Mexico extradited some prisoners to the U.S. which might help their cause. Supposedly Canada isn’t doing much about getting the seizure rate up from 1%. So, who knows? Though there was late-day chatter, primarily from Bessent, regarding a “Fortress North America.” The chatter was that Canada and Mexico might avoid tariffs with the U.S. by imposing their own tariffs on China. Interesting, and the concept of North America working well together makes a lot of sense, but that would be a pretty dramatic shift. Again, maybe all part of the “art of the deal?” More on “dealmaking” later.

As important as those tariffs might be for markets and the global economy, they all took a backseat on Friday to the televised meeting from the Oval Office. While many were present, it really boiled down to Trump, Zelensky, and Vance. I cannot remember the last time I watched anything from the Oval Office more than once – I think I’ve viewed it, in its entirety, at least twice and I’ve seen several snippets as well.

I cannot remember the internet being as binary and vocal about something since “what color is the dress” broke the internet about a decade ago.

Yes, comparing the stakes from yesterday’s meeting with something as pointless as whether a dress was blue/black or white/gold may seem like I’m trivializing something, but I’m just trying to defuse the situation long enough to make it through my take. This is my take, though it comes from conversations with journalists, our Geopolitical Intelligence Group, and others plugged into the situation. These opinions are my own, but I don’t think I can discuss where the economy is headed without at least laying the groundwork for how I’m thinking about the Russia/Ukraine/U.S. peace talks.

Maybe all of these issues will be resolved before you get to read this T-Report, but here is my take:

- The U.S. has offered Ukraine a mineral deal as part of the peace talks. That deal has been negotiated in length and by all accounts both sides seem to think the terms of the mineral deal are acceptable (in so far that it is a mineral deal).

So far so good. Then what the heck happened on Friday?

- The U.S. view is that the mineral deal is sufficient to deter Putin going forward. That it sends a strong message that the U.S. and Ukraine will be linked together economically. The logic is that Putin will take that strong message into account and not interfere, making the mineral agreement effectively a security agreement.

- The Ukrainian view is that Putin and Russia cannot be trusted, and they need a security agreement alongside the mineral agreement.

- Which brings up the question of why this meeting occurred at all? Was it to force Zelensky to accept that all he was going to get was a mineral agreement and that he had to trust that it would be effective as a security agreement? Did Zelensky think this was his opportunity to push the U.S. into providing a security agreement? Was this meant to be more of a “photo op” ahead of the final deliberations, which went sideways? It is interesting that Zelensky chose not to have an interpreter, which might have been very useful to slow things down and allow words to be used to de-escalate. I’ve always loved the Hamilton song – “The Room Where it Happens” and apparently yesterday, the entire world was in the “Room Where it Happens.”

In this case, I can see why both sides believe their points are valid.

From the U.S. perspective:

- Without a doubt, increasing economic ties and having money invested in a region will increase American presence. It will incentivize the U.S. to protect their interests. While there is not an official security agreement, which Putin might not accept anyway, this is a back door to providing a security agreement, without providing one. Subtle, but plausible.

- While Putin has broken agreements in the past (and the U.S. did too in expanding NATO), Trump believes that Putin will live up to an agreement with Trump. There were no new incursions during Trump 1.0. We have discussed in the past that having a dialogue with adversaries is the only way to achieve our goals. Trump clearly has that dialogue with Putin.

From the Ukrainian perspective.

- Putin has violated agreements. The U.S. (and others) provided security guarantees when convincing Ukraine to give up their nuclear arsenal. They have been fighting for their lives and are afraid of any deal that might just give Putin time to reorganize and rebuild. They feel they need a security agreement and signing a mineral agreement without a security agreement would leave them with even fewer cards than they already hold (or don’t hold).

- Some of the mineral deal itself seems like it is paying for what has occurred, not what is about to be. Also, the USMCA agreement was negotiated under Trump, and he hasn’t hesitated to effectively change the terms of that deal, via sanctions, when it suited him.

Zelensky might have to come back and take what was offered, even as Europe is having emergency meeting after emergency meeting on the subject.

Without the U.S. support, this likely ends badly for Ukraine, so they potentially come and take the deal, but I cannot believe that there won’t be longer-term ramifications for the global order. That may turn out great for the U.S. (clearly the admin believes it), or it might not, and only time will tell.

The Art of the Deal

One thing that became very clear, after a full-on media assault by this administration, is that:

- Trump is a dealmaking guru (and guru might understate his skills).

- Every deal Trump does is great, so everyone should do his deals.

That has always been a talking point, but it noticeably ramped up after that Oval Office meeting.

I’m not sure what it means, but the spike in volume is so noticeable that I think it is important. Maybe he is preparing the U.S. for certain deals (that might have short-term pain domestically) to win in the long run?

Jobs

Jobs week used to be more fun when we believed the numbers!

Since this is February data, I’m not sure I’d bet against weak numbers, given my concerns about seasonality adjustments overstating them.

I will point out that initial jobless claims popped up to 242k, and only a small portion of the increase can be linked to anything DOGE related. Presumably, with DOGE pushing forward, we will see jobless claims increase as people are forced out of work in the federal government.

I remain highly concerned about the ability of many who lose their jobs to get new jobs, not because of their skills or qualifications, but because my view on the economy is that the job market is far squishier than we’ve been led to believe – especially the private sector.

Unfortunately, we don’t get the JOLTS Quit rate until the following week. While there is a 1-month lag in the JOLTS data, I continue to view the Quit rate as “crowd sourced” data, as individuals are very good at understanding their own employment situation and their ability to attain another job. It has been mired at 2% on average since June, which is at the low-end of readings during “normal” times.

With so much uncertainty around the direction of trade policies, I find it difficult to believe many companies are in hiring mode. Even for those that presumably are inclined to wait and see how things play out.

Whatever the official data is, I’m looking for mediocre performance on the jobs front.

It is too early and too unclear for companies to build out and expand based on potential policies that may or may not be implemented.

It is not too early to be cautious and protect yourself against the possible risks of those policies.

Policy uncertainty basically has the opposite of buy now pay later.

The Consumer Classes

We cannot talk about “the consumer.”

The rich are doing well and continue to do well. Even with stocks basically unchanged on the year, and some serious crypto wealth taken off the table, the rich are doing well. We don’t need to spend a lot of time worrying about this class of consumer – which makes up a disproportionately large amount of consumer spending. So, with this group still performing, you cannot be too frightened about consumption.

The poor continue to struggle. Inflation. Rates. Jobs. You name it, and this group continues to struggle and may face further setbacks depending on what programs are cut. While it is harsh to say, they do not drive consumer spending, so while they are struggling, we can see overall consumption remain on track, since this class of consumer is not a force in consumption (yes, it is harsh to say, but it is true).

The middle class is where it gets interesting. While it is unclear how the Trump 2.0 policies will play out, there is clearly a path to a big rebound for the middle class. In fact, I’m eyeing a lot of what is going on in D.C. and Mar-a-Lago through the lens that Trump’s legacy might be to rebuild the middle class. The administration isn’t focused on the stock market. They aren’t focused on short-term pain. They are focused on policies that if they work out the way they are perceived they will, we will see a rise in the middle class. Not just in the number, but also in the security that those people have in their jobs. A true “middle class,” not something that sometimes feels like “just above poor.” If this is the mindset, a lot of good could happen, but that might be too far down the road for now as bumps come first and there is no certainty that every plan will play out as drawn up.

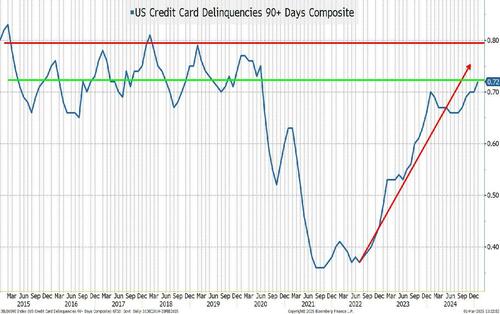

Credit card delinquencies have tracked back to about “average” for the period of 2015 through 2019. Not “alarming” but worth watching. I do like to focus on credit card debt as I think changes in Fed policy have almost no impact on problems in this market. I find it difficult to believe that paying 21% instead of 22% (or the like) has any influence on the trend. A year ago, there was a buffer here that just isn’t the case right now. It helped protect us during the recession fears in a way that isn’t achievable today.

Similarly, we had some breathing room with the amount of credit card debt outstanding.

That is clearly less the case now, as we’ve broken back above trend. I’ve highlighted it in yellow since we have had inflation and an influx of people. So maybe the trend line is too low. Also, only a portion of this is likely to be middle class and represent “tapped out spending” from people who were spending. Nonetheless, we have less wiggle room if we get a downturn.

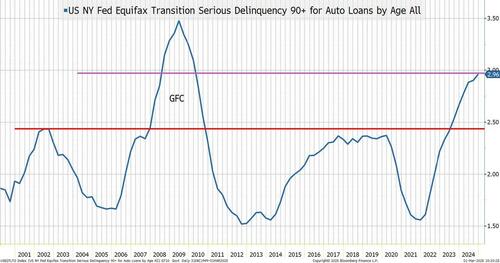

The auto loan metrics are more concerning.

Basically, we are at levels of 90+ serious delinquencies, according to this time series. That was only “achieved” during the GFC.

While we can argue that credit card problems may be impacting consumers who don’t drive consumption (no pun intended), autos seem a bit more “upscale” than that.

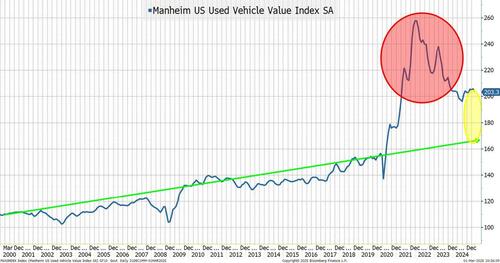

I do have an affinity for the Manheim used auto index.

I’ve included it here, because I understand that it has some impact on setting “residual” values on leases, which in turn likely influenced loan underwriting. Clearly, what we saw post-Covid was largely an anomaly that is “normalizing.” Presumably much of that increase was ignored by lenders, but it is unclear to me how much. Delinquencies rising with recovery values declining isn’t good for anyone.

All Housing is Local

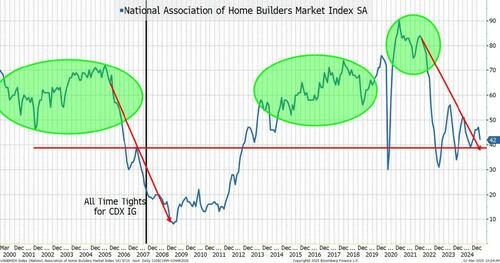

Homebuilder confidence is once again declining.

From my days of trading high yield homebuilders, I have applied two filters to this chart:

- It is always overstated! Homebuilders are typically a pretty optimistic group about their own business – probably have to be when you need to buy land potentially years in advance of development.

- They tend to do best when people are moving to new areas. Low population density areas that people want to move to afford them the best opportunity for profits (shale and fracking were big at one time, and more recently Tennessee, Florida, etc.).

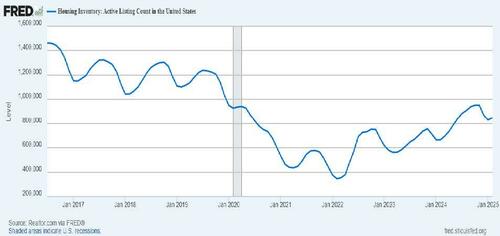

This decline is occurring while the statistic of homes for sale nationally is below trend (you will see why I brought up the second point in a moment).

While homes for sale have been creeping higher, we are still well below pre-Covid levels.

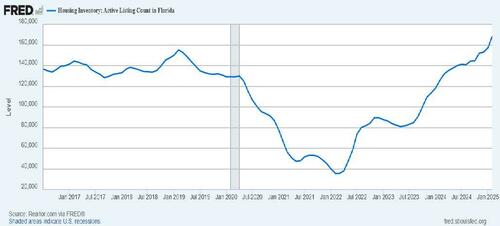

On the other hand, Florida is now at about any level we have seen in the past decade.

I was in Palm Beach last week for work (I swear it was for work), and there was no economic slowdown there. Consistent with the “rich have no problem.” But away from that there are plenty of signals that things got overbuilt. That everyone could somehow be a “landlord” and make rental money.

I’d be shocked if homes for sale in Florida are being driven by low income. This is getting to the heart of the issue. Are people stuck with homes they cannot afford (far more likely when people buy rental properties rather than primary residences)?

What went from a hotbed for the builders is now souring (the “national” level might be okay, but housing is and always will be a local thing).

You see this in some other rapid growth areas (not all of them, by any means) but enough to catch my attention.

Are the foundations (pun intended) crumbling? Or at least showing some stress fractures?

How Far Ahead Are We Skating to the Puck

Repeatedly in today’s report, we mention that policies could have, over time, very positive effects for the economy. Are we supposed to be skating there? Should we ignore potential bumps and go to where the puck will (or might) be further down the road?

I think not:

- Near-term, most policies seem to be causing disruptions and uncertainties that will hit the data and make it very difficult to move far beyond that.

- There is no certainty that the good outcomes will materialize.

- Things that occur in the near-term, if problematic enough and for long enough, could derail some of the opportunity.

- Assuming everyone will move how we want them to move, it carries its own set of risks. The best players are well aware of their own limitations and think about the unexpected from their opponents. I’m not sure how well this “red team/blue team” wargame concept is being used right now.

Expect bumpiness.

Let’s go back to the theme of the year – messy but manageable.

Things will be messy, but manageable. Whenever things seem too good to be true, fade them. Whenever things feel too bleak, buy them.

That certainly applies this weekend. The Nasdaq 100 for example is down almost 3% in a month, 6% from recent highs, but flat on the year. So, while being bearish, let’s take into account that we’ve already had some substantial moves to the downside.

Outlook – The Fed and Rates

The market is currently pricing in a 35% chance of a cut by the end of the May meeting. I think that is low.

Looking for 75 bps to 100 bps of cuts this year, starting with the May meeting.

That is based on the view that the existing data will be revised down, putting us in a weaker position than is being priced in AND that the data going forward is poised to deteriorate.

We might not need that many cuts this year if the positive consequences of policy start hitting us sooner rather than later.

We could have deals with Canada, Mexico, Russia/Ukraine, China, and Europe in a matter of weeks. That could unleash the good far sooner (and make it far more likely that the good outcomes occur).

We will back off the negative near-term outlook in a heartbeat if we see that.

Until then, uncertainty, in an already fragile economy, will show up as weaker data.

While we haven’t mentioned it, government spending was an important factor in the data for the past few years and that looks like it is getting trimmed quickly.

The 10-year at 4.21% seems a touch rich to me, even with my more aggressive view on the Fed’s path. There are so many moving factors here, but I think a push back towards 4.4% is more likely than a gap to 4%, even with my weaker economic outlook (tariffs, deficits, and foreign buying may all weigh on longer term yields).

Outlook – Credit and Equities

I can’t help but start with the Russell 2000. Down 11% in 3 months! Even after Friday’s bounce, it is back to levels from September 2024. All the post-election gains have evaporated. Short interest remains high.

We’ve been focused on China (FXI up 11% in a month and 15% YTD). Energy stocks, via XLE, have outperformed.

I think on the equity side, as simplistic as this might sound, you want to:

- Be overweight anything that falls into the National Security = National Production theme. Clearly the U.S. plan with Ukraine fits this narrative perfectly.

- Be overweight things that are under-owned or shorted. I’ve liked value, but will add some small caps now, as they have taken potentially more of a drubbing than they deserve.

- If a stock has a leveraged ETF tracking it, and that leveraged ETF continues to get inflows, be wary. Those stocks can do well with inflows into those ETFs having a nice impact, but I cannot think of a more obvious “froth meter” than single stock leveraged ETFs.

Credit has done quite well so far. I highlighted early 2007 in one of the charts because I vaguely remember credit trading at all time tights. Making CDX IG 29 locked on a billion and being told that another firm was same priced, but locked on $10 billion! Yet a few moments later, credit was for sale.

One of my other favorite metrics is “semi-old” new issues. Not yesterday’s or very recent issues, as even if they widen, they tend to be very liquid. But the stuff that is a couple of weeks old tends to get illiquid once the dealers don’t feel the need to support it. It might not widen, but it becomes difficult to “trade on the wire.” That tends to be an early sign of potential weakness moving forward and seems to be occurring.

The S&P 500 and VIX tend to correlate to IG better than other equity metrics. While both recovered on Friday, they too aren’t sending a warm and fuzzy measure.

Finally, what we have seen on the equity front (away from the Russell 2000) has been more about valuations. The equal weighted Nasdaq and S&P 500 have outperformed the market weighted versions. But if the next leg of equity weakness is less about valuations and more about concerns about the economy, then it will be more difficult for credit to avoid widening.

Credit spreads have been boring and so far are not signaling any sort of real economic fear, but look for that to change.

Bottom Line

They say March’s weather is “in like a lion, out like a lamb.” That may be true of the market situation as the past couple of weeks have not been kind to equities, but it could improve. Maybe even as soon as the end of this month.

It is certainly possible, and we will be watching the headlines out of D.C. to try to catch that swing.

But, for now, I suspect that we will still be riding that bucking bronco into April, when a bunch of new tariffs are scheduled to be implemented after April Fool’s Day. Maybe everything will coalesce by then, and we will have smooth sailing for all-time highs in markets and an incredibly healthy and robust economy! But I’m not there yet.

With the speed of headlines coming out, I’m only hopeful that I don’t have to do this report again before it is edited and distributed, and I hope it is still sensical by Monday morning when I typically resend it!

Tyler Durden

Sun, 03/02/2025 – 14:50

Share This Article

Choose Your Platform: Facebook Twitter Linkedin