These Are The Nations With The Highest (And Lowest) Marginal Income Tax Rates

It’s tax filing time for quite a few countries, as their financial year comes to end.

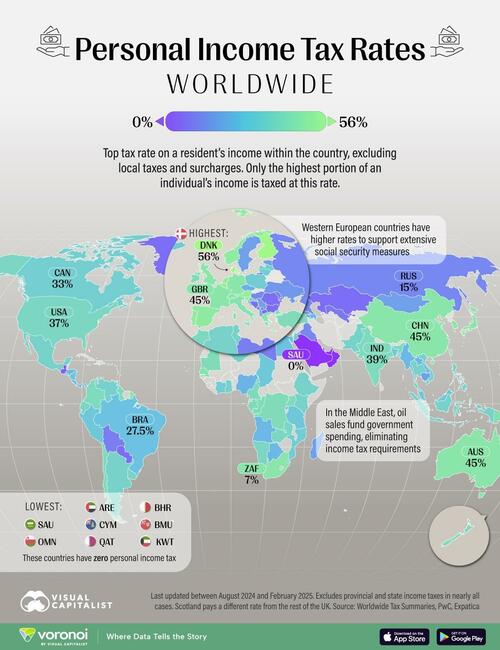

How differently do countries tax their citizens? Visual Capitalist’s Pallavi Rao took a look at the top marginal individual income tax rates of nearly 150 countries to compare and contrast differences.

Data for this map is sourced from PwC’s Worldwide Tax Summaries, updated between Aug 2024–Feb 2025.

Of course there are limitations to the data. Only the highest portion of an individual’s income is taxed at this rate, and brackets vary significantly on how much money falls into that pool.

Furthermore, property, sales, or other indirect taxes are not included. It also omits state, provincial, and municipal taxes

Ranked: Countries by their Highest Personal Income Tax Rate

Western European countries on average have the highest headline income tax rates in the world.

Per the source, seven countries have a 50%+ top rate, and six of those are in Europe, led by Denmark at 55.9%.

| Rank | Country | ISO Code | Headline Personal Income Tax Rate |

|---|---|---|---|

| 1 | 🇩🇰 Denmark | DNK | 55.9 |

| 2 | 🇫🇮 Finland | FIN | 55 |

| 3 | 🇱🇺 Luxembourg | LUX | 51 |

| 4 | 🇦🇹 Austria | AUT | 50 |

| 5 | 🇧🇪 Belgium | BEL | 50 |

| 6 | 🇮🇱 Israel | ISR | 50 |

| 7 | 🇸🇮 Slovenia | SVN | 50 |

| 8 | 🇳🇱 Netherlands | NLD | 49.5 |

| 9 | 🇵🇹 Portugal | PRT | 48 |

| 10 | 🇳🇴 Norway | NOR | 47.4 |

| 11 | 🇪🇸 Spain | ESP | 47 |

| 12 | 🇨🇭 Switzerland | CHE | 45.5 |

| 13 | 🇦🇺 Australia | AUS | 45 |

| 14 | 🇨🇳 China | CHN | 45 |

| 15 | 🇩🇪 Germany | DEU | 45 |

| 16 | 🇫🇷 France | FRA | 45 |

| 17 | 🇬🇧 UK | GBR | 45 |

| 18 | 🇯🇵 Japan | JPN | 45 |

| 19 | 🇰🇷 South Korea | KOR | 45 |

| 20 | 🇿🇦 South Africa | ZAF | 45 |

| 21 | 🇬🇷 Greece | GRC | 44 |

| 22 | 🇮🇹 Italy | ITA | 43 |

| 23 | 🇸🇳 Senegal | SEN | 43 |

| 24 | 🇵🇬 Papua New Guinea | PNG | 42 |

| 25 | 🇨🇱 Chile | CHL | 40 |

| 26 | 🇨🇩 DRC | COD | 40 |

| 27 | 🇨🇬 Congo | COG | 40 |

| 28 | 🇬🇦 Gabon | GAB | 40 |

| 29 | 🇬🇾 Guyana | GUY | 40 |

| 30 | 🇮🇪 Ireland | IRL | 40 |

| 31 | 🇲🇷 Mauritania | MRT | 40 |

| 32 | 🇳🇨 New Caledonia | NCL | 40 |

| 33 | 🇹🇷 Türkiye | TUR | 40 |

| 34 | 🇹🇼 Taiwan | TWN | 40 |

| 35 | 🇺🇬 Uganda | UGA | 40 |

| 36 | 🇨🇴 Colombia | COL | 39 |

| 37 | 🇮🇳 India | IND | 39 |

| 38 | 🇳🇿 New Zealand | NZL | 39 |

| 39 | 🇨🇲 Cameroon | CMR | 38.5 |

| 40 | 🇲🇦 Morocco | MAR | 38 |

| 41 | 🇪🇨 Ecuador | ECU | 37 |

| 42 | 🇳🇦 Namibia | NAM | 37 |

| 43 | 🇺🇸 U.S. | USA | 37 |

| 44 | 🇿🇲 Zambia | ZMB | 37 |

| 45 | 🇺🇾 Uruguay | URY | 36 |

| 46 | 🇭🇷 Croatia | HRV | 35.4 |

| 47 | 🇦🇷 Argentina | ARG | 35 |

| 48 | 🇨🇾 Cyprus | CYP | 35 |

| 49 | 🇩🇿 Algeria | DZA | 35 |

| 50 | 🇪🇹 Ethiopia | ETH | 35 |

| 51 | 🇬🇭 Ghana | GHA | 35 |

| 52 | 🇮🇩 Indonesia | IDN | 35 |

| 53 | 🇰🇪 Kenya | KEN | 35 |

| 54 | 🇲🇽 Mexico | MEX | 35 |

| 55 | 🇲🇹 Malta | MLT | 35 |

| 56 | 🇵🇰 Pakistan | PAK | 35 |

| 57 | 🇵🇭 Philippines | PHL | 35 |

| 58 | 🇹🇭 Thailand | THA | 35 |

| 59 | 🇹🇳 Tunisia | TUN | 35 |

| 60 | 🇻🇳 Vietnam | VNM | 35 |

| 61 | 🇻🇪 Venezuela | VEN | 34 |

| 62 | 🇨🇦 Canada | CAN | 33 |

| 63 | 🇱🇻 Latvia | LVA | 33 |

| 64 | 🇵🇷 Puerto Rico | PRI | 33 |

| 65 | 🇸🇿 Eswatini | SWZ | 33 |

| 66 | 🇨🇮 Côte d’Ivoire | CIV | 32 |

| 67 | 🇱🇹 Lithuania | LTU | 32 |

| 68 | 🇲🇿 Mozambique | MOZ | 32 |

| 69 | 🇵🇱 Poland | POL | 32 |

| 70 | 🇮🇸 Iceland | ISL | 31.35 |

| 71 | 🇧🇩 Bangladesh | BGD | 30 |

| 72 | 🇯🇲 Jamaica | JAM | 30 |

| 73 | 🇯🇴 Jordan | JOR | 30 |

| 74 | 🇱🇨 Saint Lucia (assumed “Saint”) | KNA | 30 |

| 75 | 🇲🇾 Malaysia | MYS | 30 |

| 76 | 🇳🇮 Nicaragua | NIC | 30 |

| 77 | 🇵🇪 Peru | PER | 30 |

| 78 | 🇷🇼 Rwanda | RWA | 30 |

| 79 | 🇸🇻 El Salvador | SLV | 30 |

| 80 | 🇹🇩 Chad | TCD | 30 |

| 81 | 🇹🇿 Tanzania | TZA | 30 |

| 82 | 🇧🇧 Barbados | BRB | 28.5 |

| 83 | 🇧🇷 Brazil | BRA | 27.5 |

| 84 | 🇨🇻 Cabo Verde | CPV | 27.5 |

| 85 | 🇪🇬 Egypt | EGY | 27.5 |

| 86 | 🇦🇴 Angola | AGO | 25 |

| 87 | 🇦🇿 Azerbaijan | AZE | 25 |

| 88 | 🇧🇼 Botswana | BWA | 25 |

| 89 | 🇨🇷 Costa Rica | CRI | 25 |

| 90 | 🇩🇴 Dominican Republic | DOM | 25 |

| 91 | 🇬🇮 Gibraltar | GIB | 25 |

| 92 | 🇬🇶 Equatorial Guinea | GNQ | 25 |

| 93 | 🇭🇳 Honduras | HND | 25 |

| 94 | 🇱🇦 Laos | LAO | 25 |

| 95 | 🇱🇧 Lebanon | LBN | 25 |

| 96 | 🇲🇲 Myanmar | MMR | 25 |

| 97 | 🇵🇦 Panama | PAN | 25 |

| 98 | 🇸🇰 Slovakia | SVK | 25 |

| 99 | 🇹🇹 Trinidad & Tobago | TTO | 25 |

| 100 | 🇳🇬 Nigeria | NGA | 24 |

| 101 | 🇸🇬 Singapore | SGP | 24 |

| 102 | 🇦🇱 Albania | ALB | 23 |

| 103 | 🇨🇿 Czechia | CZE | 23 |

| 104 | 🇱🇮 Liechtenstein | LIE | 22.4 |

| 105 | 🇮🇲 Isle of Man | IMN | 22 |

| 106 | 🇦🇲 Armenia | ARM | 20 |

| 107 | 🇪🇪 Estonia | EST | 20 |

| 108 | 🇬🇪 Georgia | GEO | 20 |

| 109 | 🇬🇬 Guernsey | GGY | 20 |

| 110 | 🇯🇪 Jersey | JEY | 20 |

| 111 | 🇰🇭 Cambodia | KHM | 20 |

| 112 | 🇲🇬 Madagascar | MDG | 20 |

| 113 | 🇲🇳 Mongolia | MNG | 20 |

| 114 | 🇲🇺 Mauritius | MUS | 20 |

| 115 | 🇷🇸 Serbia | SRB | 20 |

| 116 | 🇸🇪 Sweden | SWE | 20 |

| 117 | 🇺🇦 Ukraine | UKR | 18 |

| 118 | 🇭🇰 Hong Kong | HKG | 16 |

| 119 | 🇭🇺 Hungary | HUN | 15 |

| 120 | 🇮🇶 Iraq | IRQ | 15 |

| 121 | 🇲🇪 Montenegro | MNE | 15 |

| 122 | 🇵🇸 Palestinian Territories | PSE | 15 |

| 123 | 🇷🇺 Russia | RUS | 15 |

| 124 | 🇧🇴 Bolivia | BOL | 13 |

| 125 | 🇱🇾 Libya | LBY | 13 |

| 126 | 🇲🇴 Macau | MAC | 12 |

| 127 | 🇲🇩 Moldova | MDA | 12 |

| 128 | 🇺🇿 Uzbekistan | UZB | 12 |

| 129 | 🇧🇬 Bulgaria | BGR | 10 |

| 130 | 🇧🇦 Bosnia & Herzegovina | BIH | 10 |

| 131 | 🇬🇱 Greenland | GRL | 10 |

| 132 | 🇰🇿 Kazakhstan | KAZ | 10 |

| 133 | 🇲🇰 North Macedonia | MKD | 10 |

| 134 | 🇵🇾 Paraguay | PRY | 10 |

| 135 | 🇷🇴 Romania | ROU | 10 |

| 136 | 🇹🇱 Timor-Leste | TLS | 10 |

| 137 | 🇽🇰 Kosovo | XKX | 10 |

| 138 | 🇬🇹 Guatemala | GTM | 7 |

| 139 | 🇦🇪 UAE | ARE | 0 |

| 140 | 🇧🇭 Bahrain | BHR | 0 |

| 141 | 🇧🇲 Bermuda | BMU | 0 |

| 142 | 🇰🇾 Cayman Islands | CYM | 0 |

| 143 | 🇰🇼 Kuwait | KWT | 0 |

| 144 | 🇴🇲 Oman | OMN | 0 |

| 145 | 🇶🇦 Qatar | QAT | 0 |

| 146 | 🇸🇦 Saudi Arabia | SAU | 0 |

Note: Denmark’s figure includes a mandatory labor market tax for all wage earners in the country. Scotland pays a different rate than the rest of the UK.

But as always, the fine print contains more useful information. For example, in Denmark, the top bracket for employment income is 15%. However, this combines with the bottom bracket tax and mandatory healthcare and municipal contributions to raise the income tax ceiling. Finally, income from shares and dividends also attracts a high rate of 42%.

In the U.S., the 37% headline rate is only applicable to income above $609,000 for individuals. Of course, U.S. states tax their residents as well.

And finally, several Middle Eastern countries—also oil producers—don’t charge an income tax.

The Pros and Cons of Western Europe’s High Tax Rates

Individual income taxes often make up the largest source of government revenues.

Thus, higher taxes help fund extensive public services like healthcare, education, and social security.

It can also potentially reduce income inequality by redistributing wealth, supporting lower-income citizens, and fostering social cohesion.

However, less disposable income leads to less consumer spending. And better-skilled workers with higher earnings may relocate, leading to brain drain from the region.

High earners can avoid taxes by routing their incomes or businesses through low tax jurisdictions. Check out Ranked: The World’s Top 10 Tax Havens to see how much offshore wealth is parked around the globe.

Tyler Durden

Sun, 03/09/2025 – 07:35

Share This Article

Choose Your Platform: Facebook Twitter Linkedin