Why Deflation Is Good For The Economy

Authored by Frank Shostak via The Mises Institute,

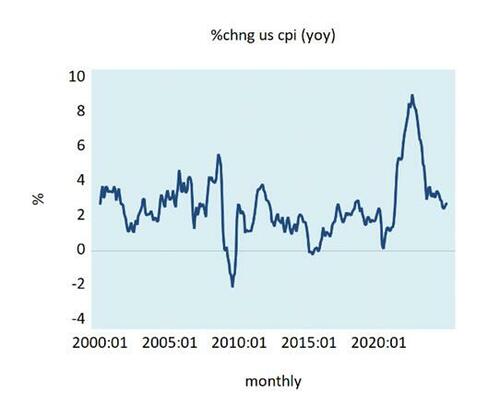

The yearly growth rate of the consumer price index (CPI) stood at 2.7 percent in November, against 2.6 percent in October. In June 2022, the yearly growth rate was 9.1 percent.

The price of a good is the amount of money asked per unit of some particular good at which an exchange will obtain. It follows, then, that if the quantity of money increases faster than the quantity of goods, the price of goods will also increase, all other things being equal.

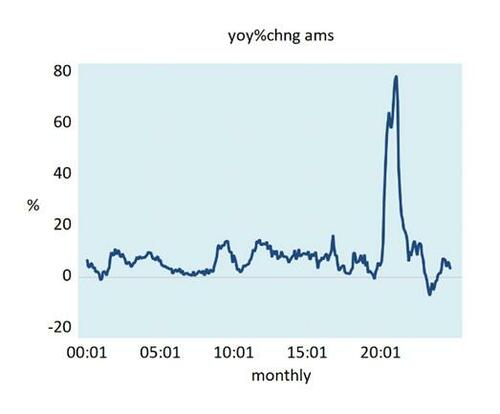

When money is injected, it enters a particular market and then moves through the price structure to other markets. The injected money does not spread instantaneously to all the markets, there is a time lag. The yearly growth rate of our monetary measure—AMS for the US—stood at 79 percent in February 2021 against 3.7 percent in October this year.

It is estimated that the average time lag from changes in money supply and changes in prices as depicted by the consumer price index the CPI is about 26 months. This suggests that the massive decline in the momentum of the CPI is because of the large decline in the yearly growth rate of the money supply. Again, the yearly growth rate of money supply fell from 79 percent in February 2021 to 3.7 percent by October this year.

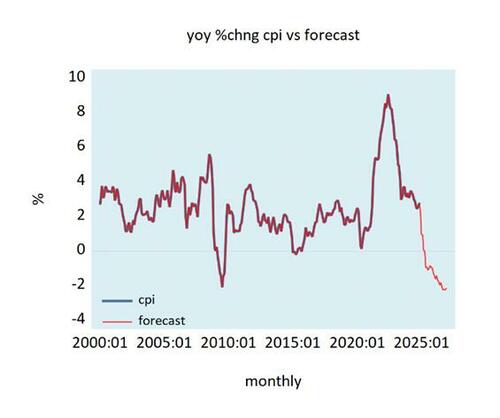

On account of the time lag, it is quite likely that the yearly growth rate of the CPI is poised for a further visible decline ahead. Based on the lagged money supply growth rate, it is quite likely that the yearly growth rate of the CPI will turn negative from the second half of next year (see chart).

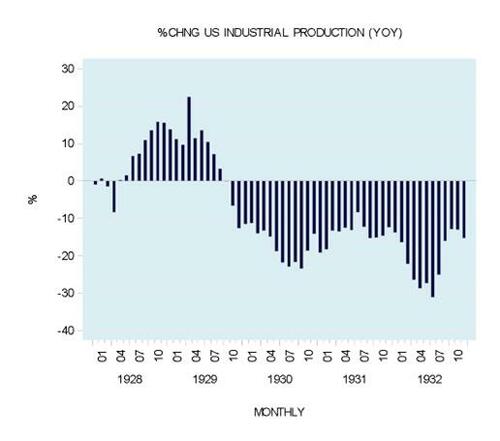

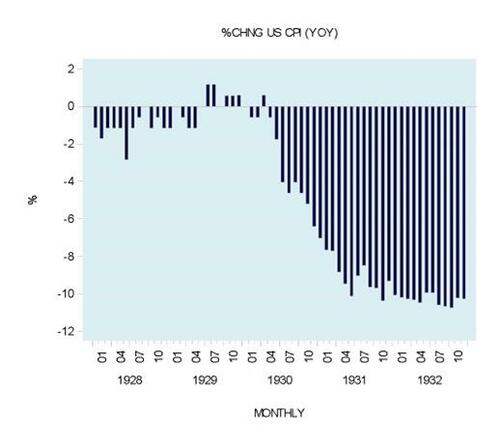

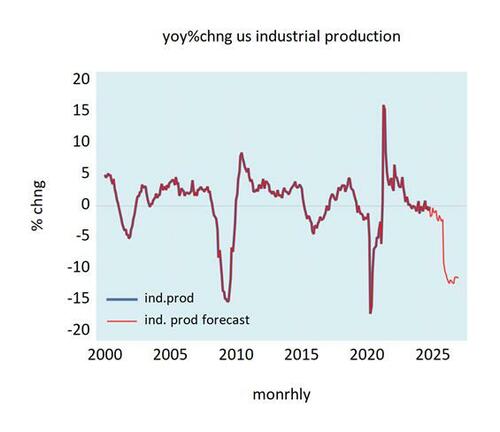

The negative figure in the yearly growth rate of the CPI raises the likelihood that most commentators will start warning about deflation and the threat that it is going to pose to the economy. A general decline in the prices of goods and services is regarded by most experts as bad news since it is seen to be associated with major economic slumps such as the Great Depression of the 1930’s. Note that, by July 1932, the yearly growth rate of industrial production fell to –31 percent, while by September 1932, the yearly growth rate of the consumer price index plunged to –10.7 percent.

According to many economists, when prices decline it is harder for borrowers to pay down existing debts, leading to growing defaults, while banks become reluctant to extend credit. Consequently, these two factors generate a downward spiral in the supply of credit and a consequent decline in economic activity.

Furthermore, most experts regard a general decline in prices as “bad news” because it raises expectations for a further decline in prices, and this, it is held, slows down individuals’ propensity to spend, which, in turn, undermines investment in plant and machinery. These factors set in motion an economic slump. Moreover, as the slump further depresses the prices of goods, this intensifies the pace of economic decline. It is for these reasons that many economic experts are of the view that it is the duty of the central bank—the Fed in the US—to prevent deflation.

In his speech before the National Economists Club (Washington, DC, November 21, 2002), entitled “Deflation: Making Sure ‘it’ Doesn’t Happen Here,” Ben Bernanke—then a Fed governor—laid out measures that the central bank should employ to combat deflation, such as buying longer-maturity Treasury debt and the “helicopter money.”

For most experts the occurrence of economic depression is because of a collapse in aggregate demand. In this view, since demand causes supply, the central bank should embark on massive monetary expansion in order to boost the demand for goods and services. According to much popular thinking, a strengthening in aggregate demand will set in motion the increase in the production of goods and services (i.e., economic growth).

But why would an increase in demand lead to an increase in the supply? Without a suitable infrastructure, no expansion in the supply is going to emerge because of the increase in the demand. Also, to suggest that consumers postpone their buying of goods at present because prices are expected to decline would mean that individuals have abandoned any desire to live in the present. However, without the maintenance of life in the present, no future life is conceivable.

Contrary to such thinking, deflation, which is manifested by declining prices, is the mechanism that makes a great variety of goods produced more accessible to individuals. Murray Rothbard wrote,

[I]mproved standards of living come to the public from the fruits of capital investment. Increased productivity tends to lower prices (and costs) [i.e., deflation] and thereby distribute the fruits of free enterprise to all the public, raising the standard of living of all consumers. Forcible propping up of the price level prevents this spread of higher living standards.

How the Central Bank Makes Things Worse

Whenever the central bank artificially inflates money into the economy this benefits various individuals engaged in activities which sprang up on the back of the expansionary monetary policy, at the expense of true wealth-generators. Through expansionary monetary policy, the central bank gives rise to a class of individuals whose ventures could not come into existence without continued inflation and which distort the structure of production.

The consumption by these recipients of the newly generated money and credit is made possible through the diversion of real savings from wealth producers. Through this process, these recipients divert production, saving, and capital investment without contributing anything in return.

The expansionary monetary policy of the central bank generates an environment where it appears that it is possible to consume without production. Not only does the easy-money policy raise the prices of existing goods, but monetary inflation also gives rise to the production of goods and assets which would otherwise not be the case. These goods are not demanded in those amounts and/or prices by consumers.

Once the central bank reverses its expansionary monetary policy, the diversion of production from wealth producers to non-wealth producers is arrested. This, in turn, undermines the demand of non-wealth-producers for various goods and services thereby exerting downward pressure on their prices.

A tighter monetary policy undermines various activities that sprang up the previous expansionary monetary policy. This partially halts the bleeding of wealth generators. The decline in prices comes in when prices realistically realign with the new production caused by previous inflation. Deflation during recession signifies the beginning of economic healing.

As a rule, what the central bank tries to stabilize is the so-called “price index.” The alleged success of this policy, however, hinges on the state of saving, capital investment, and production. As long as saving expands, a bout of inflation generates the illusion that the expansionary monetary policy is the right remedy. This is because the inflationary expansion of money and credit, which renews the flow of real savings to non-wealth-producers, props up their demand for goods and services, thereby halting or even reversing the decline in prices. Furthermore, if saving and capital investment is still growing, the pace of economic growth stays positive. Hence, the mistaken view that an inflationary monetary policy can reverse deflation (falling prices) is the key in reviving economic activity.

The illusion that through inflation it is possible to keep the economy going is shattered once savings begin to decline and the distortions in the capital structure are recognized. Once this happens, the economy begins a downward plunge. The most aggressive expansionary monetary policy would fail to reverse this plunge. Even if easy-money policies were to succeed in raising prices and inflationary expectations, this could not revive the economy.

Considering the declining momentum of the lagged money supply growth rate, and the likely shrinking savings and capital investment, economic activity could enter a severe recessionary phase from the second half of 2025.

Conclusion

Contrary to the popular view, deflation is good for the economy. Thus, when prices are declining in response to the expansion of wealth, this means that individuals’ living standards are rising. Further, when prices decline because of the bursting of a financial bubble, it is also overall good for the economy, for it indicates that the impoverishment of wealth producers is being arrested.

Tyler Durden

Tue, 01/07/2025 – 20:05

Share This Article

Choose Your Platform: Facebook Twitter Linkedin