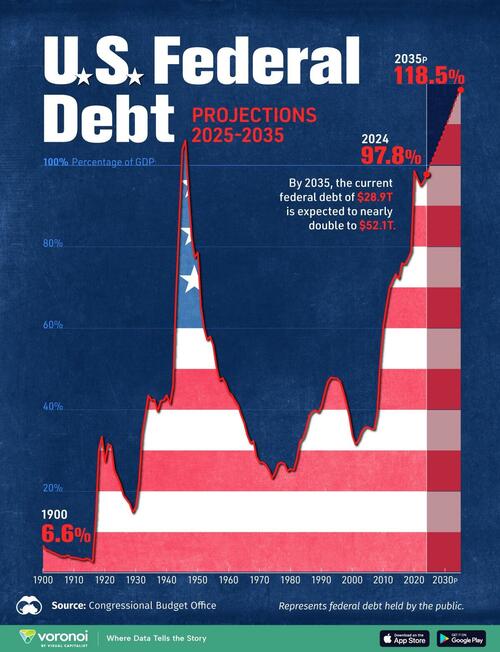

‘Worse Than World War II’ – Visualizing US National Debt (As A Percent Of GDP) Since 1900

This year, U.S. national debt is set to approach 100% of GDP, up from 36% in 2005.

By 2035, the tab is projected to reach 118.5% of GDP as higher debt costs steepen the deficit, fueling further government borrowing. Today, the deficit stands at $1.9 trillion with net interest and mandatory spending outpacing revenues.

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows U.S. federal debt projections to 2035, based on data from the Congressional Budget Office.

Swimming in Debt

Below, we show how national debt held by the public is set to mushroom over the next decade:

| Year | U.S. Federal Debt as a % of GDP |

|---|---|

| 2035P | 118.5 |

| 2034P | 117.1 |

| 2033P | 115.3 |

| 2032P | 113.0 |

| 2031P | 111.1 |

| 2030P | 109.2 |

| 2029P | 107.2 |

| 2028P | 105.4 |

| 2027P | 103.4 |

| 2026P | 101.7 |

| 2025P | 99.9 |

| 2024 | 97.8 |

| 2023 | 96.0 |

| 2022 | 95.0 |

| 2021 | 96.9 |

| 2020 | 98.6 |

| 2019 | 78.9 |

| 2018 | 77.1 |

| 2017 | 75.7 |

| 2016 | 76.0 |

| 2015 | 72.2 |

| 2014 | 73.3 |

| 2013 | 71.8 |

| 2012 | 70.0 |

| 2011 | 65.5 |

| 2010 | 60.6 |

| 2009 | 52.2 |

| 2008 | 39.2 |

| 2007 | 35.2 |

| 2006 | 35.4 |

| 2005 | 35.8 |

| 2004 | 35.7 |

| 2003 | 34.7 |

| 2002 | 32.7 |

| 2001 | 31.5 |

| 2000 | 33.7 |

| 1999 | 38.3 |

| 1998 | 41.7 |

| 1997 | 44.6 |

| 1996 | 47.0 |

| 1995 | 47.7 |

| 1994 | 47.8 |

| 1993 | 47.9 |

| 1992 | 46.8 |

| 1991 | 44.1 |

| 1990 | 40.9 |

| 1989 | 39.4 |

| 1988 | 39.9 |

| 1987 | 39.6 |

| 1986 | 38.5 |

| 1985 | 35.3 |

| 1984 | 33.1 |

| 1983 | 32.2 |

| 1982 | 27.9 |

| 1981 | 25.2 |

| 1980 | 25.5 |

| 1979 | 25.0 |

| 1978 | 26.7 |

| 1977 | 27.1 |

| 1976 | 26.7 |

| 1975 | 24.6 |

| 1974 | 23.2 |

| 1973 | 25.2 |

| 1972 | 26.5 |

| 1971 | 27.1 |

| 1970 | 27.1 |

| 1969 | 28.4 |

| 1968 | 32.3 |

| 1967 | 31.9 |

| 1966 | 33.8 |

| 1965 | 36.8 |

| 1964 | 38.8 |

| 1963 | 41.1 |

| 1962 | 42.3 |

| 1961 | 43.6 |

| 1960 | 44.3 |

| 1959 | 46.5 |

| 1958 | 47.8 |

| 1957 | 47.3 |

| 1956 | 50.7 |

| 1955 | 55.8 |

| 1954 | 58.0 |

| 1953 | 57.2 |

| 1952 | 60.1 |

| 1951 | 65.5 |

| 1950 | 78.6 |

| 1949 | 77.4 |

| 1948 | 82.4 |

| 1947 | 93.9 |

| 1946 | 106.1 |

| 1945 | 103.9 |

| 1944 | 86.4 |

| 1943 | 69.2 |

| 1942 | 45.9 |

| 1941 | 41.5 |

| 1940 | 43.6 |

| 1939 | 42.4 |

| 1938 | 42.2 |

| 1937 | 39.6 |

| 1936 | 42.5 |

| 1935 | 42.4 |

| 1934 | 43.5 |

| 1933 | 38.6 |

| 1932 | 34.0 |

| 1931 | 22.0 |

| 1930 | 16.3 |

| 1929 | 14.8 |

| 1928 | 17.0 |

| 1927 | 18.0 |

| 1926 | 19.0 |

| 1925 | 21.6 |

| 1924 | 23.5 |

| 1923 | 25.2 |

| 1922 | 31.1 |

| 1921 | 31.6 |

| 1920 | 27.3 |

| 1919 | 33.4 |

| 1918 | 30.2 |

| 1917 | 13.3 |

| 1916 | 2.7 |

| 1915 | 3.3 |

| 1914 | 3.5 |

| 1913 | 3.2 |

| 1912 | 3.4 |

| 1911 | 3.6 |

| 1910 | 3.7 |

| 1909 | 3.8 |

| 1908 | 4.3 |

| 1907 | 4.0 |

| 1906 | 4.0 |

| 1905 | 4.3 |

| 1904 | 4.7 |

| 1903 | 5 |

| 1902 | 5.4 |

| 1901 | 5.7 |

| 1900 | 6.6 |

By 2029, federal debt is forecast to exceed the post-WWII record based on an outlook that doesn’t factor in recessions.

This comes amid a widening deficit during a period of low unemployment and a growing U.S. economy. In many ways, this counters the theory of shrinking the deficit during economic expansion and increasing the deficit during downturns.

Looking ahead, net interest on the federal debt is expected to nearly double from 2024 levels, reaching $1.8 trillion by 2035. To put it in perspective, interest costs will be 1.7 times higher than defense spending that year.

While Modern Monetary Theory suggests that countries that have control over their currencies will never face default since they can print more money, evidence from history suggests a different outcome.

From the British Empire and Habsburg Spain to the Ottoman Empire, historian Niall Ferguson finds that superpowers that have spent more on debt servicing costs than defense have not held onto power for very long.

To learn more about this topic amid swelling debt, check out this graphic on the top holders of U.S. debt.

Tyler Durden

Fri, 02/07/2025 – 21:20

Share This Article

Choose Your Platform: Facebook Twitter Linkedin